Chainsaw 2.0

Get ready for the deep cuts...

“Now, the deep chainsaw is coming.”

~ Javier Milei

Joel Bowman with today’s Note From the End of the World: Buenos Aires, Argentina...

Don’t look now, dear reader... but the deep cuts are still to come...

Here’s the man with the motosierra himself, Argentina’s president, Javier Milei (from X):

YOU'VE ALREADY MET THE CHAINSAW, NOW MEET CHAINSAW 2.0

Argentina has 27,000 laws in force, 70,000 executive orders, and 200,000 resolutions. We are going to ask each department of the state to make a list of the ones in use... and we’ll terminate the rest.

Sr. Milei went on to acknowledge that Argentines voted for him to lower inflation, lower poverty, grow the economy, and generally Make Argentina Great Again.

“And I am doing just that,” he concluded, vowing to redouble his efforts ahead of the country’s congressional elections, scheduled for October of this year.

Taking Sr. Milei’s points one at a time, one catches a glimpse of the wonders a free(r) market bestows upon a population patient and committed enough to endure the measures required to achieve it. Herewith...

We begin with Item #1 on Milei’s to-do list: Lower inflation

Employing a series of bizarre economic policies – like balancing the budget by not spending money the government doesn’t have on things its citizens don’t need – Milei’s administration managed to drag his nation’s beleaguered peso back from the brink of hyperinflation.

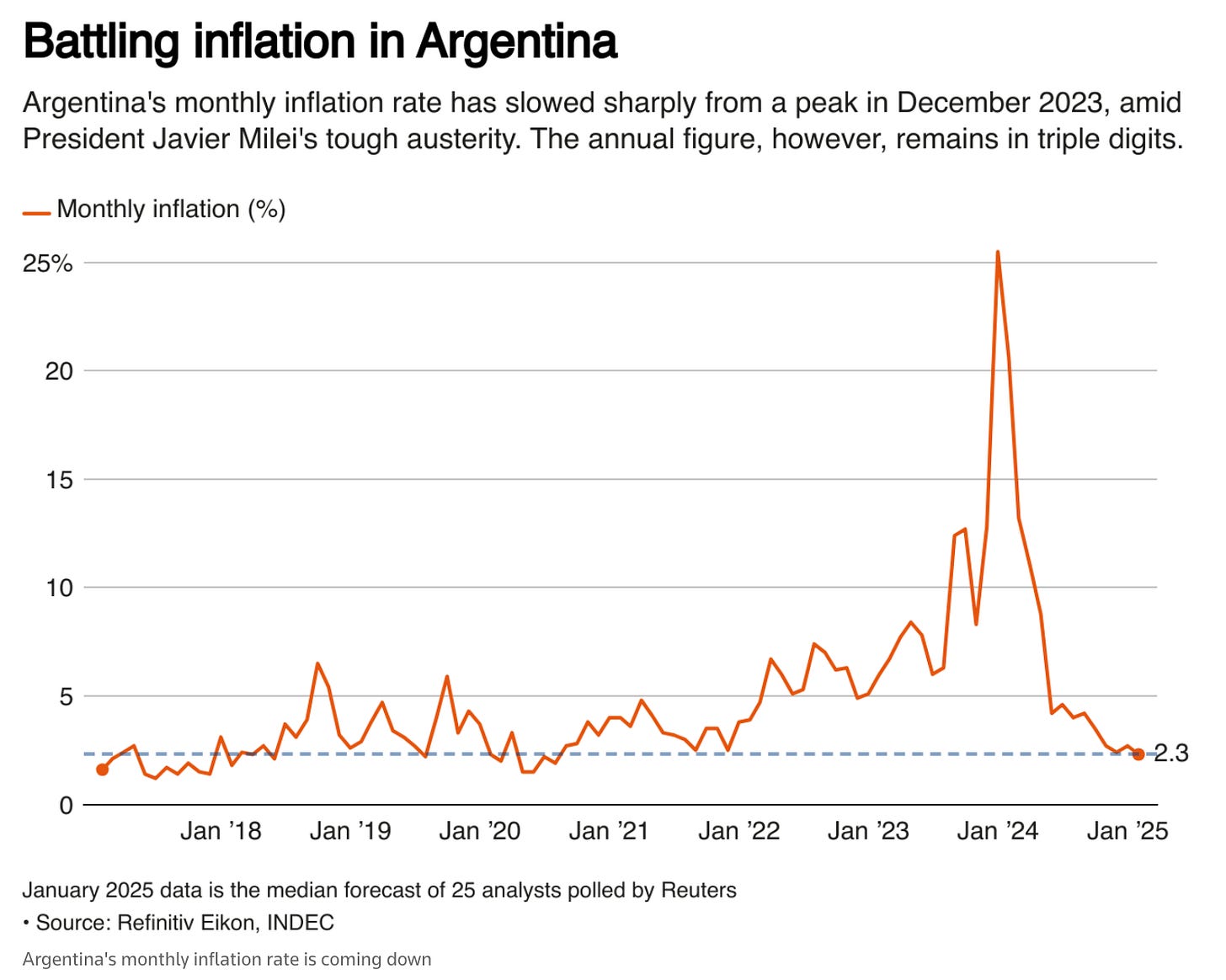

Longtime Notes readers will recall that the monthly inflation rate stood at a knee-quivering 25.5% when Milei took office, in December of 2023...

And today?

Here’s USAID-funded newswire, Reuters, reporting the latest estimates, through firmly gritted teeth, this very morning...

BUENOS AIRES, Feb 13 (Reuters) - Argentina's monthly inflation rate likely hit its lowest level since libertarian President Javier Milei came to power in late 2023, ushering in painful austerity measures, a Reuters poll of analysts showed ahead of data due on Thursday.

The consumer price index (CPI) likely rose 2.3% in the first month of 2025, according to the median estimate from 25 analysts polled by Reuters. If achieved, that would be down from 2.7% in December and mark the slowest monthly rise since the middle of 2020.

And here’s us, at the entirely independent, reader funded Notes From the End of the World, going to press with the updated figures, released at 4pm Thursday afternoon, Buenos Aires time:

Inflation here in Argentina slowed to 2.2% for the month of January, marking the lowest level since July, 2020, according to figures released from the National Institute of Statistics (INDEC):

Annualized inflation figures also fell considerably, down from a high of 289% in April of last year to 84.5% for January, 2025.

C’mon, mainstream lackeys... journalisming ain’t that hard!

Lowering inflation? Check.

Moving along then to Item #2 on Sr. Milei’s to-do list: Lower poverty

It will come as something of a surprise to money-printing Keynesians that the resulting inflation is actually – wait for it... – bad for an economy... especially those poor souls clinging desperately to the bottom rungs of the ladder, about whom our econo-PhD class so conspicuously pretend to care.

Government maximalists and Reuters “journalists” alike will therefore be shocked to discover that, as inflation down here on the Pampas has cooled from scorching to merely red hot, poverty too has declined in step.

According to the very latest data, released by INDEC and processed by the Torcuato Di Tella University (UTDT), poverty fell from 52.9% in the first half of 2024 (a hangover from the previous administration’s fiat print-a-thon) to below 40% in the second half of the year. From La Derecha Diario:

The poverty nowcast study, prepared by UTDT economist Martín González Rozada, estimates a rate of 36.8% for the July-December period, with a 95% confidence interval that ranges between 35.3% and 38.2%.

Here’s that graph, from UTDT:

Broken down further, the rate actually fell from 38.8% in Q3 to 34.8% for the fourth quarter, according to INDEC figures, which is the lowest level since 2019, before the previous administration proved itself a friend of poverty... and not of the poor.

Lowering poverty? Check.

Now for Item #3 on Milei’s to-do list: Grow economy

As reported previously in these Notes, Argentina officially emerged from recession in the third quarter of last year, when gross domestic product (GDP) grew 3.9% in the July-to-September quarter compared with the previous three months. (That’s not an annualized figure, btw... that’s just for the quarter.)

On top of that, real salaries are outpacing inflation, delivering purchasing power back into the hands (and pocketbooks) of Argentine savers and consumers. In 2024, according to official data, salaries increased 145.5% against an inflation rate of 117.8%.

December’s real monthly gain, of 3.1%, marked the 9th consecutive month that salaries beat inflation. From INDEC:

While registered private sector wage growth handily surpassed public sector growth, at 2.8% and 1.7% respectively, the anarcho-capitalists among us (you know who you are!) will be delighted to hear that it was non-registered private sector wage growth that rocketed the most... quadrupling public sector growth to clock a massive 6.8% growth for the month (and almost 200% for the year).

Grow the economy? Check.

As for Item #4 on the to-do list, “Making Argentina Great Again,” that remains an ongoing project. Suffice to say, the chainsaw is off to a roaring start.

And the real deep cuts are still to come...

Stay tuned for more Notes From the End of the World...

Cheers,

Joel Bowman

P.S. Finally today, a bonus item... taken from our very own Investing in the End of the World playbook.

As Argentina’s economy claws its way back to what even J.P. Morgan recently dared call “normalcy,” it stands to reason international investors would begin looking for opportunities down here in these vast, resource rich lands.

“The geology is there,” as our guests explained during our inaugural investment summit last month, “it’s the political landscape that has prevented investors from diving in with both feet.”

Since taking office, the aforementioned policies of Milei’s administration have translated into a significant reduction in the country’s perceived risk, with the Risk Index (measured by J.P. Morgan), falling from over 2,000 points when Milei came to power... to ~660 as we went to “print” this afternoon.

Among the many international companies lately dipping their toes is a Canadian mining company which, as of this week, submitted a request to join an Argentine government incentives program that would afford it significant tax breaks for its Los Azules copper project in San Juan province.

According to filings, the company plans to invest $2.7 billion in the mine and has committed $227 million under the Argentine government's Large Investment Incentive Regime (RIGI) to carry out the mine's feasibility study, do exploration works, and prepare for construction.

As it happens, the company was just one of a dozen or so highlighted by our guest speakers – Rick Rule, Byron King and Eric Fry – during our two hour Investing in the End of the World summit last month. Fancy that.

If you missed the summit but would like an executive summary of the event, simply click here. Meanwhile, members can access the entire, 2-hour audio-video recording of the event, including a full transcript, here.

If you’re not already a Notes member, you can gain full access to all that material by joining our growing ranks today…

Nota Bene: Our next summit is tentatively scheduled for early April. Once again, capacity will be limited for the event and Notes members will be given preference (as well as access to audio-video recordings and full transcripts, in case you’re unable attend on the day).

If you’d like to guarantee your seat at the table, please consider supporting our work and becoming a Notes Member today...

I continue to find it hilarious that, after almost 100 years of being an economic basket case, little Argentina righted the ship so quickly by letting a wild-eyed character like Milei do the most stupidly obvious things. It is just *chef's kiss*...perfect.

After reading the ever-morose writings of Reuters, I get a glazed-over look in my eyes (when seen through my mirror) as I wonder: What are those so-called journalists clamoring for? Do they want to see Argentina continue to be the country of the next century? It's like the lamestream presstitutes in the US that keep wondering why President Trump is more successful in under a month than Joke Briben was in four years!

The press are finding ways to cheer for losers while the winners pile up victories in front of their eyes. And they fail to report what happens right in front of their eyes.